Effective May 21, 2023, P&N has joined EisnerAmper. Read the full announcement here.

Last updated on 7/6/2020

Current State

The impacts of COVID-19 have been felt in many areas of the economy, and the M&A market is no exception. A dramatic slowdown in deal volume has occurred in recent months as companies continue to experience adverse impacts of the pandemic, amplified in certain markets by the additional decline in oil prices.

*Source: Capital IQ

With decreased cash flows and general uncertainty, would-be sellers have been reluctant to seek a sale for fear of “selling low” in the current environment of depressed valuations, therefore creating a constrained deal market. In the following section, we provide some insight into the discussions about a potential recovery and how long until it might occur.

Empirical Studies

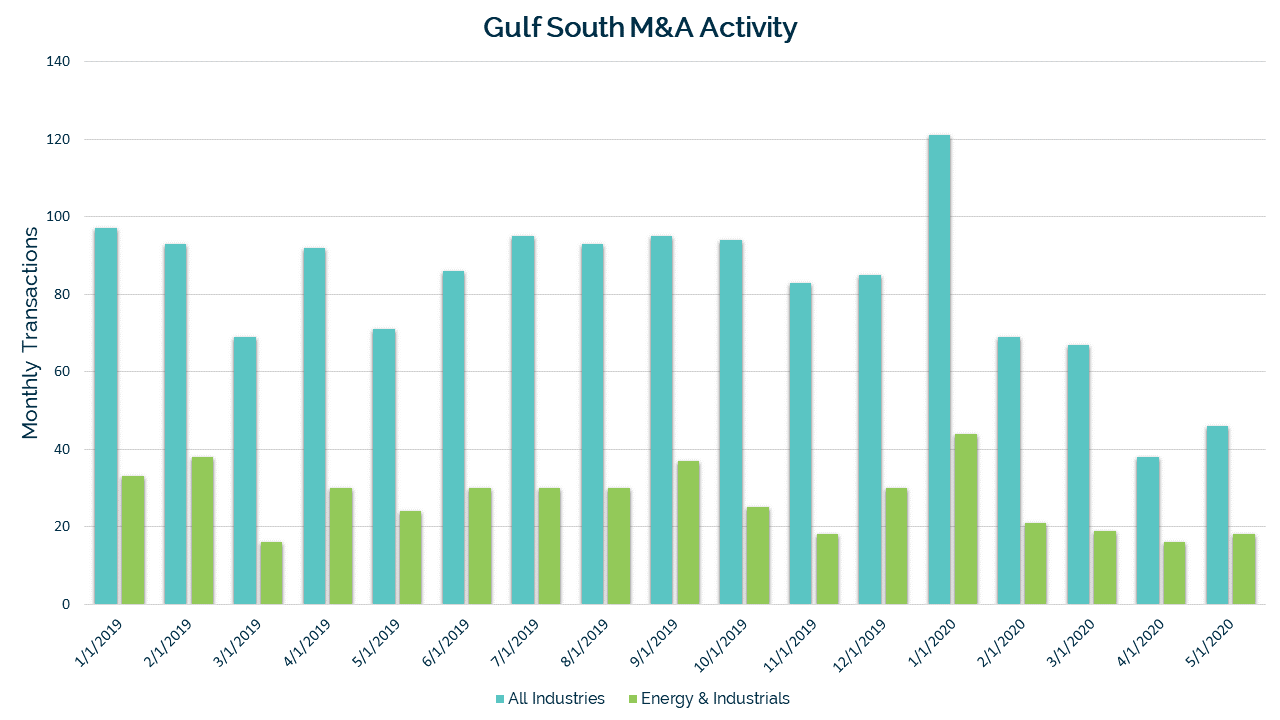

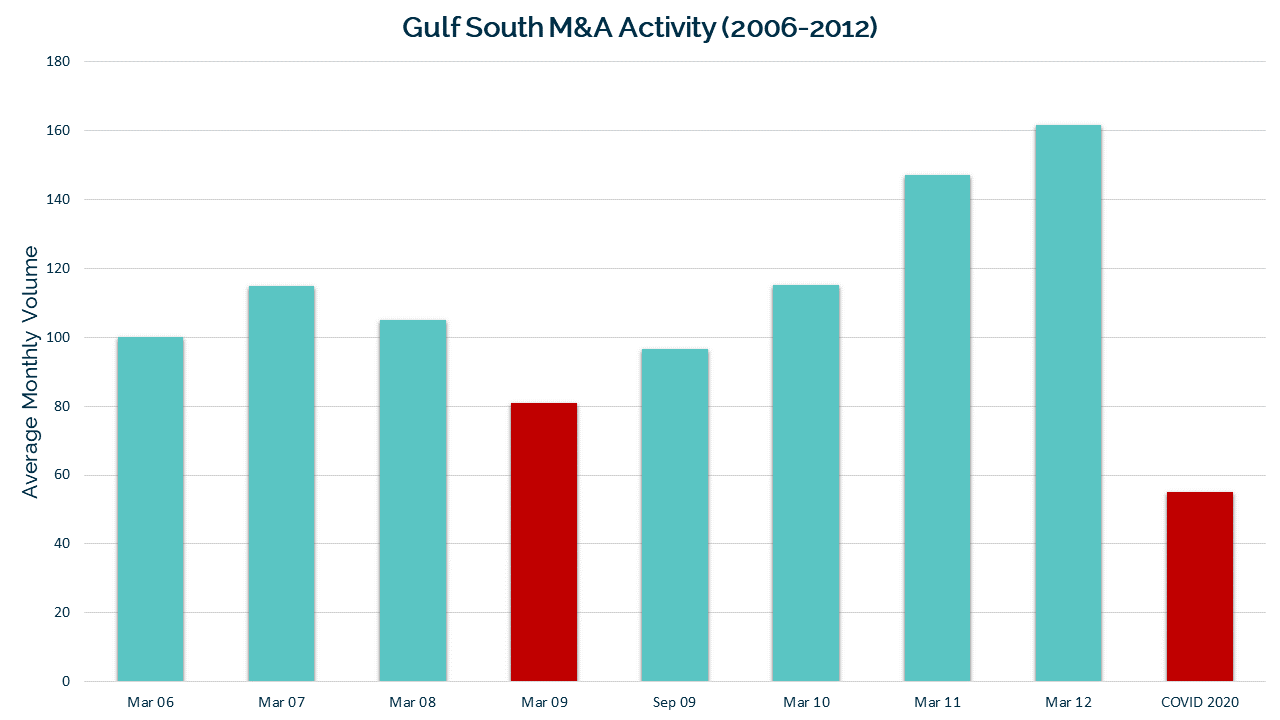

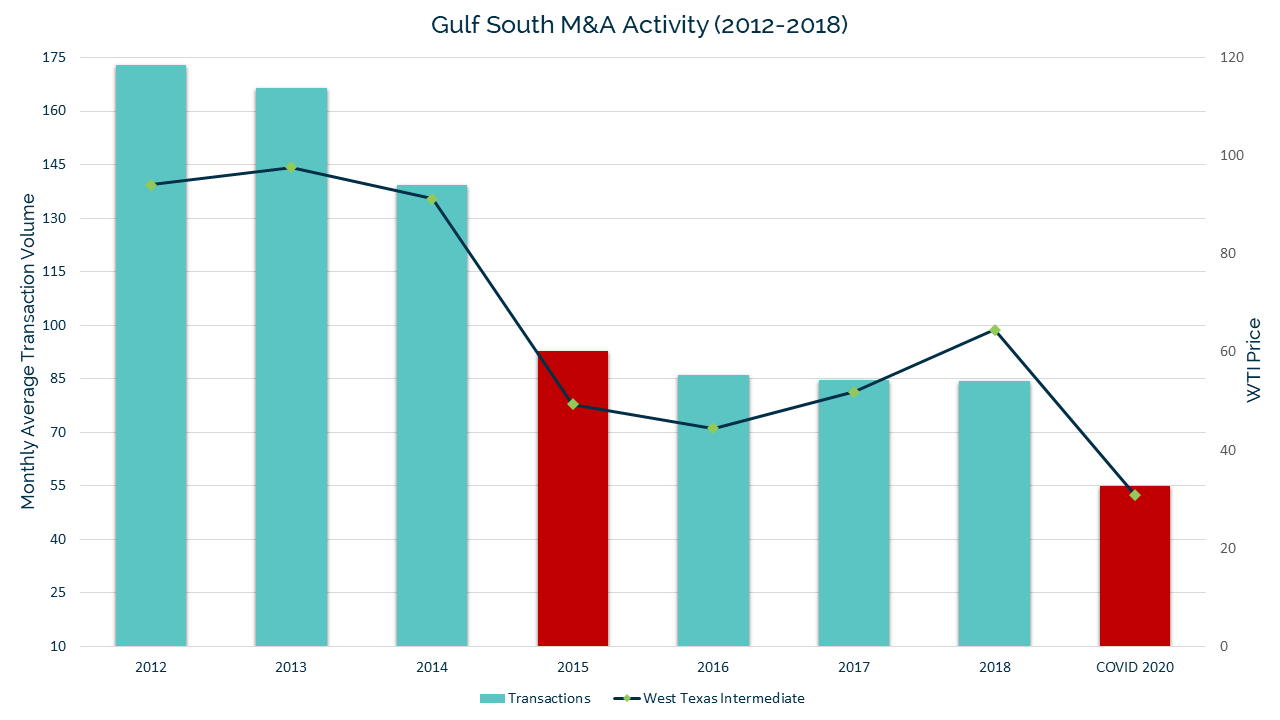

COVID-19 is impacting businesses and capital markets in ways we have not seen before. In order to understand how deal volume may recover from the current crisis, we analyzed deal volume trends in two other major economic events affecting the Gulf South in recent history: the Great Recession of 2007-2008 and the oil price collapse of 2014-2015.

Great Recession (2007-2008)

*Source: Capital IQ

Key Observations:

- During the six-month low market period from October 2008 through March 2009, deal volume dropped significantly from historical levels.

- Deal volume returned to pre-Great Recession levels within two years and continued to rise to historical levels in 2011 and 2012.

- The economy was “bailed out” of the Great Recession by stimulus provided through large banks, which “trickled down” to businesses and individuals. Conversely, stimulus efforts from COVID-19 have been provided largely directly to business owners and individuals, with the expectation of recovery to “trickle up” throughout the economy.

Conclusion:

There are many parallels in an economic sense between the Great Recession and COVID-19, such as the global macroeconomic impact and government response in the form of stimulus. One could therefore look to the pattern of recovery from the Great Recession and apply it to COVID-19, which would indicate a relatively quick recovery of deal volume as the economy rebounds.

Oil Price Collapse (2014-2015)

*Source: Capital IQ

Key Observations:

- Oil prices collapsed at the end of 2014 and remained low throughout 2015 with still no recovery to pre-2015 prices.

- Gulf South deal volume has yet to return to pre-2015 levels and was closely correlated with WTI prices over the observation period. Over this same period, broad based stock market levels were relatively unaffected, suggesting that deal volume in the Gulf South region is more sensitive to oil prices than to overall market levels.

Conclusion:

Based on the historical correlation of Gulf South deal volume and oil prices, one could expect that future deal volume will increase with a rebound in energy prices. While several factors have impacted energy prices recently, a primary driver was presumably the decrease in global demand as economies around the world abruptly shut down. As economies open up and demand returns, oil prices are expected to recover to some degree, and deal volume may follow suit.

Finding Opportunities in Uncertain Times

While the current downturn has had devastating effects on many segments of the economy, opportunities still exist. Economic downturns and slowed deal volume lead to lower values for many assets, which favor tax planning strategies for long-term family wealth management and create capital deployment opportunities for buyers. Estimating and understanding value, either for tax compliance or investment decisions, is critical to unlocking these opportunities, and P&N’s tax, valuation, and transaction advisors are here to help.

Alternatively, business owners who choose to weather the current storm can use this time to position the company for a sale when markets do recover. Many businesses will reimagine their cost structures, supply chains, physical footprints, and marketing strategies, and P&N’s team of financial and operational consultants can help you navigate these changes and understand their impact on value.

Lastly, the aging demographics of business owners was a significant factor driving the volume of M&A activity prior to COVID-19, as many owners have a large percentage of their retirement vested in the sale proceeds from an eventual exit of their business. While COVID-19 will not change the age of business owners, it may impact the timeline and/or the structure of an eventual exit. P&N can help you navigate through possible scenarios and participate in discussions with other stakeholders and professional advisors (upon your direction) to help you gain a better understanding of all options.

Based on P&N’s analysis, deal volume is expected to recover, and taking appropriate actions now can help better position businesses for future opportunities. Contact us for assistance or to learn more.