Effective May 21, 2023, P&N has joined EisnerAmper. Read the full announcement here.

Once a business owner(s) has identified the next generation leader(s), the logistics of making the transition introduces more questions, options and challenges. Every family business is different, and no two transition plans will look alike. The construction industry, in particular, faces its own set of challenges, such as:

- Business development is deeply rooted in relationships that are often difficult to transition.

- Management teams include non-family members who may be hesitant to follow the younger generation.

- The industry’s cyclical nature can create difficulties in the timing of transitions. During growth periods, contractors are focused on running their business and maximizing profits, and during lull periods, contractors are trying to find the next project to “keep the lights on.”

- Industry trends demand new skills and ways of thinking on matters such as attracting and developing talent and leveraging technology.

According to Family Business Succession, The Final Test of Greatness, there are several routes that family business owners can take to transition to the next generation. Each of these options has advantages and disadvantages, and you should discuss these with your family and advisory team to create a plan that makes the most sense for you.

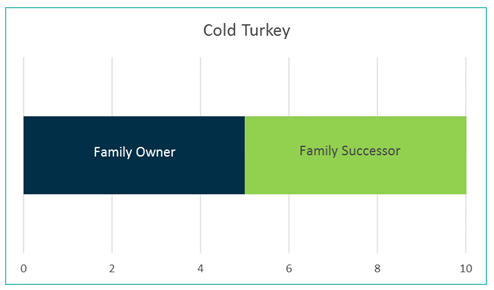

Cold Turkey: The owner(s) maintains control until a ‘trigger event’. These triggers can be voluntary (retirement) or involuntary (death, accident or illness).

| Advantages | Disadvantages |

|

|

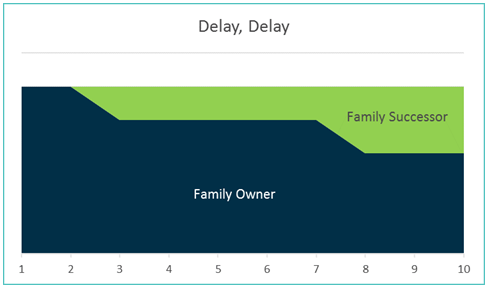

Delay, Delay: The owner(s) promises to transition but can never give up complete control.

| Advantages | Disadvantages |

|

|

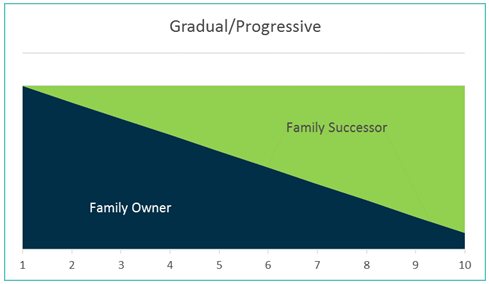

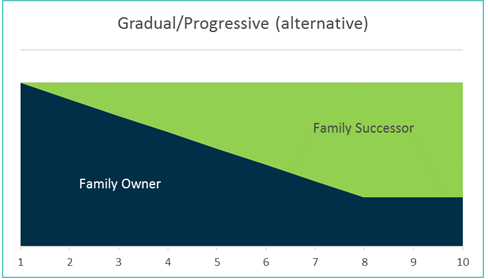

Gradual/Progressive: The owner(s) gradually cedes responsibilities over a period of time (i.e., five or six years), and at some point, the owner(s) has successfully transitioned to the successor(s). Or, it is possible that the owner(s) never fully transitions, but assumes a more focused role.

| Advantages | Disadvantages |

|

|

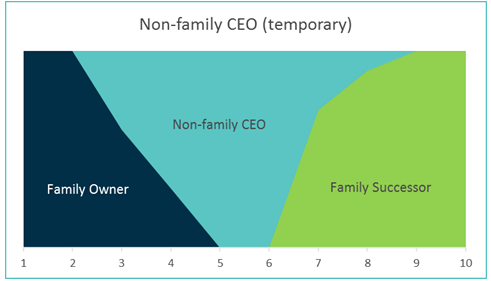

Non-family CEO (temporary): The owner has identified a family successor(s), but the successor(s) is not ready. This often happens with age gaps, or the successor coming into the business later in life. In such instances, a non-family CEO may assume responsibility from the owner(s) and mentor the successor(s) until the retirement of the non-family CEO.

| Advantages | Disadvantages |

|

|

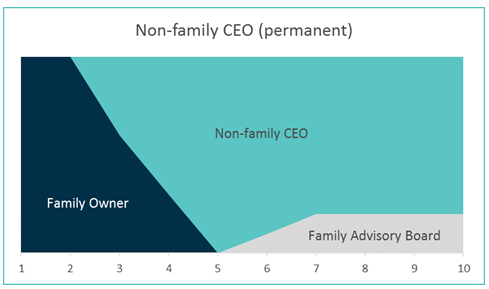

Non-family CEO (permanent): The owner(s) do not have a family successor(s), but wish to keep the business in the family. In this option, the family may establish a family advisory board and transition ownership to the next generation, but CEO responsibilities are transitioned to a non-family CEO. In this instance, a Family Office may be established where the family runs multiple business and philanthropic efforts.

| Advantages | Disadvantages |

|

|

This article is part of a series focusing on family business challenges in the construction and industrial markets. P&N is a full-service accounting and advisory firm with experienced professionals who can help family businesses succeed.

Contact us to start a discussion today.