Effective May 21, 2023, P&N has joined EisnerAmper. Read the full announcement here.

When you are on an accounting team, the quickly approaching year-end can elicit feelings of stress and fear instead of joy. Believe it or not, year-end can be a painless process in the accounting world. Start preparing now so you can breeze through your year-end processes and enjoy the beginnings of a New Year! The tips below and our year-end webinar will help you get started.

Overall Preparations

If you begin in December, you will get a head start on updating data and forming a strategy prior to the new year. Here are a few items you should consider as the year-end approaches.

- Establish a calendar that contains all deadlines and due dates

- Remind all employees of year-end deadlines

- Review vacation schedules to ensure adequate staffing

- Assign year-end tasks to appropriate team members

As this list indicates, establishing a calendar that contains all applicable deadlines and due dates will keep the team on-task during this season. Consider making this calendar accessible to all members of the accounting team, so everyone is aware of the deadlines and whether they are met or even exceeded.

|

Date |

Item |

|

1/31/2020 |

1099-MISC All Boxes – VENDOR Copy* |

|

1/31/2020 |

1096 & 1099-MISC Non-Employee Compensation (Box 7) – IRS Paper or Electronic Filing |

|

2/28/2020 |

1099-MISC all other boxes – IRS Paper Filing |

|

3/31/2020 |

1099-MISC all other boxes – IRS Electronic Filing |

* The IRS recommends providing these documents to employees as early as possible to reduce the number of filed corrections required.

Reviewing employee vacation schedules and the company holiday schedule will allow your company to plan for adequate staffing during the holiday season. Communication of year-end closing expectations and federal/state form deadlines with appropriate staff provides good time to discuss how each team member can contribute to the company’s year-end success. With your team on board and a plan of action, year-end can be a breeze!

Accounts Payable Preparations

There are several things that need to take place in order to manage your 1099 Forms with ease. Below is a quick checklist to review for your Accounts Payable year-end processing.

- Clean up vendor master files

- Verify all required information for 1099 vendors

- Ensure W-9 Forms are on file for all vendors

- Confirm that there are no duplicate records

- Order 1099 Forms (if printing in-house)

- Order extra to account for printing errors

- Ensure all 2019 invoices and payments are entered

- Verify the accuracy of 1099 amounts

- Print draft 1099 Forms to blank paper (if printing in-house)

- Generate and/or electronically submit the 1099 Forms

- Print in-house via Sage Intacct

- E-file via Sage Intacct Marketplace Partner

Vendor Master Files

When reviewing your vendor records in preparation of year-end processing, verify that you have received W-9 Forms from all of your vendors. If you are missing any, now is the time to reach out to obtain them. Also, make sure you do not have duplicate vendors in your accounting system. This can result in misreporting amounts on 1099 Forms and may prevent population of a 1099 Form from for a duplicated vendor. Next, verify that all of your 2019 invoices and payments are accounted for within your system. Once the 1099’s are issued, all payments should be recorded in 2020 or a Corrected 1099 Form may be required.

Printing 1099 Forms In-House

If you are printing your forms in-house, order your forms early from www.formsforintacct.com to avoid the stress of waiting for a late delivery. Order plenty to allow for errors – we all make mistakes and so do printers! Before printing everything, print one copy on plain paper and compare to your forms to check alignment. If adjustments are needed, visit the Sage Intacct Community article here for guidance on updating the form alignment.

1099 E-Filing via Marketplace Partners

Sage Intacct will allow you to export the 1099 records to Excel, but does not provide any Vendor Form Delivery or E-Filing service for your 1099 Forms. Review the Marketplace for options on e-filing, if interested. Tax1099.com is a Sage Intacct Marketplace Partner that can provide IRS-approved e-file options for 1099, 1098, W2, and 940/941/944 filing. This tool has integrations with Sage Intacct and Bill.com software programs, allowing you to avoid duplicative data entry for 1099 processing.

Payroll Preparations

Since Sage Intacct does not include a payroll function, you probably have this area covered! However, we wanted to ensure you have the important dates related to payroll to include in your year-end calendar.

|

Date |

Item |

|

1/31/2020 |

W-2 Form – Employee Copy* |

|

1/31/2020 |

1094 & 1095 Forms – Employee Copy* |

|

1/31/2020 |

W-2 & W-3 Forms – Federal Filing |

|

1/31/2020 |

940 & 941 Forms – Federal Filing |

|

2/28/2020 |

1094 & 1095 Forms – Federal Paper Filing |

|

3/31/2020 |

1094 & 1095 Forms – Federal Electronic Filing |

* The IRS recommends providing these documents to employees as early as possible to reduce the number of filed corrections required.

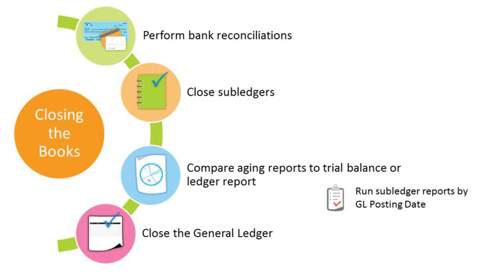

Closing the Books

Closing each month and year within your accounting system is an important step in controlling your company’s books. The General Ledger year-end close in Sage Intacct is essentially the same process as closing any other period. This task does require proper permissions within the Sage Intacct environment and can be performed from the top-level or entity-level.

Prerequisite

For fiscal years that operate in a different range than a standard calendar year, you must first ensure the reporting period is created.

- To view or create a new reporting period, go to General Ledger > Setup > More > Reporting Periods.

- For example, if your fiscal year runs from March through February, create a reporting period named "Fiscal year ending 2019" to include the full period.

For fiscal years that match calendar years, the reporting period is automatically created for you upon the closing process.

Close the Books Process

Within Sage Intacct, you can close any transactions in sub-ledgers for the appropriate "year ending" period. Periods that have not yet been closed should appear within the drop-down list in the Close window. To close sub-ledgers and the General Ledger together, go to General Ledger > All > Books > Close. As needed, close sub-ledgers (or summaries) for Accounts Payable (AP), Accounts Receivable (AR), Time & Expenses (TE), Client Expenses (CE), and Cash Management.

We hope this article helps ease the anxiety of the approaching year-end and allows you create a plan of action to accomplish your year-end tasks with ease. If you need help with your year-end, please contact us.

Related Webinar: Prepare for a Smooth Year-End in Sage Intacct