Effective May 21, 2023, P&N has joined EisnerAmper. Read the full announcement here.

As we approach the end of 2020, many are sighing with relief; however, if you are an accounting team member, you may be feeling stressed. The new requirement to report nonemployee compensation on the 1099-NEC form instead of the 1099-MISC is a major change that calls for advance preparations for year-end reporting. Preparing now will put you on the path to success for year-end reporting and compliance, so you can breathe a little easier at the start of the new year!

Jump to:

Overall Preparations

If you begin preparing in December, you will reduce your January stress and approach the new year with a strategy to complete the year-end reporting tasks timely. Here are a few items you should consider as the year-end approaches:

- Establish a calendar that contains all deadlines and due dates.

- Remind all employees of year-end deadlines.

- Review vacation schedules to ensure adequate staffing.

- Assign year-end tasks to appropriate team members.

As this checklist indicates, establishing a calendar that contains all applicable deadlines and due dates will help keep the team on-task during this season. Consider making this calendar accessible to all members of the accounting team, so everyone is aware of the deadlines and can help meet or even exceed them. With your team on board and a plan of action, year-end can be stress-free!

|

Deadline |

Item |

|

2/1/2021 |

NEW! 1099-NEC Copy B for Nonemployee Compensation – VENDOR Copy* |

|

2/1/2021 |

1096 and 1099-NEC Copy A for 1099-NEC– IRS Paper or Electronic Filing |

|

2/1/2021 |

1099-MISC Copy B – VENDOR Copy* |

|

3/1/2021 |

1096 and 1099-MISC Copy A– IRS Paper Filing |

|

3/31/2021 |

1096 and 1099-MISC Copy A– IRS Electronic Filing |

* The IRS recommends providing these documents to employees as early as possible to reduce the number of filed corrections required.

Accounts Payable Preparations

There are several things that need to take place so that your 1099 forms can go out with ease. Below is a quick checklist to review for your Accounts Payable year-end processing.

- Clean up vendor master files.

- Verify all required information for 1099 vendors:

- Tax ID Number;

- Proper form and box selection.

- Confirm that W-9 Forms are on file for all vendors.

- Confirm no duplicate records.

- Verify all required information for 1099 vendors:

- Order 1099 Forms (if printing in-house).

- Ensure you have the correct forms:

- NEW: 1099-NEC for nonemployee compensation.

- Allow for printing errors with form counts.

- Ensure you have the correct forms:

- Ensure all 2020 invoices and payments are entered and captured on the correct form and box.

- Verify accuracy of 1099 amounts.

- Important: Due to the transition from 1099-MISC Box 7 to 1099-NEC Box 1, double check all nonemployee compensation vendors to ensure the proper amounts are reported.

- Print draft 1099 Forms to blank paper (if printing in-house).

- Generate and/or electronically submit the 1099 forms.

- Print in-house via Sage Intacct.

- E-file via Sage Intacct Marketplace Partner.

New Form 1099-NEC for Nonemployee Compensation

The IRS is using a new Form 1099-NEC this year to report nonemployee compensation. Instead of reporting compensation that you pay to nonemployees (such as lawn care providers, office cleaning staff, and other independent contractors) on Form 1099-MISC in Box 7, that information will be reported on Form 1099-NEC. These updates affected data capture within Sage Intacct. In order to report your nonemployee compensation properly this year, you must update both the vendors and bills that were paid for these vendors during the 2020 calendar year. The steps below will guide you on these updates, if you have not yet completed this task.

- Run and save 1099-MISC reports for each entity.

- Select detail.

- Update vendors.

- Create a custom view.

- Filter for only 1099-MISC Box 7.

- Export list and use vendor import template to update the vendors.

- Delete all extra fields from the import template file with the exception of Vendor ID, 1099 Form, and 1099 Box to prevent vendor information from being replaced by blanks!

- Update existing transactions.

- Use the Vendor 1099 Transaction Update import template to update bills.

- There are a few exceptions to what will be updated with this import. For example, bills posted to 2019 but paid in 2020 will not be updated, nor will any existing opening vendor balances.

- Run 1099-MISC reports for each entity.

- Note any remaining balances for Box 7 vendors that were not moved to the 1099-NEC form during the previous steps.

- Manually update remaining balances by entering 1099 Opening Balances within the Vendor Edit view or import them using the Vendor 1099 Opening Balances

- Run 1099-NEC reports for each entity and compare them to the original 1099-MISC reports you saved to validate the totals.

- Create a custom view.

You can also find more information on these updates in Sage Intacct’s article: “Migrate 1099-MISC Box 7 values to the 1099-NEC form.”

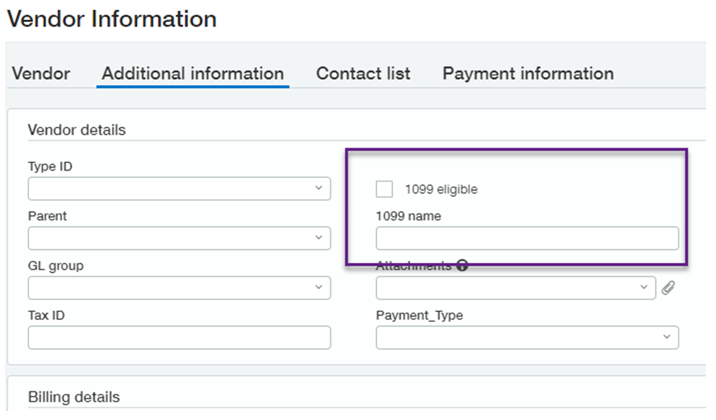

Vendor Master Files

When reviewing your vendor records in preparation for year-end processing, check that you have received W-9 Forms from all of your vendors. If you are missing any, now is the time to reach out to obtain them.

It’s also a good time to confirm that you do not have duplicate vendors in your system. This can result in misreporting amounts on 1099 forms and may prevent population of a 1099 form for a duplicated vendor.

Now that your vendors have been reviewed, ensure that all of your 2020 invoices and payments are accounted for within your system. Finally, once the 1099 forms are issued, all payments should be recorded in 2020 or a Corrected 1099 form may be required.

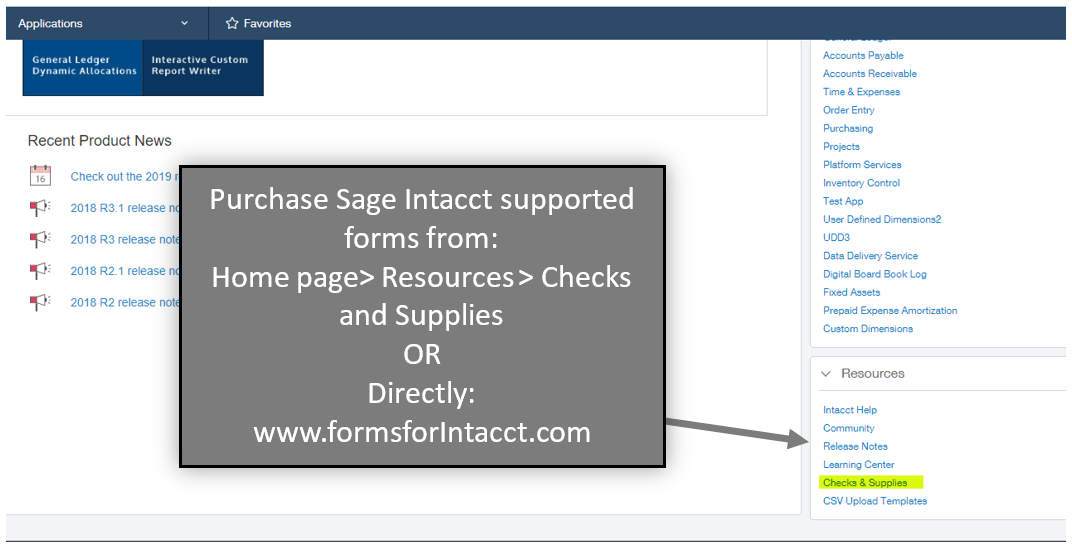

Printing 1099 Forms In-House

If you are printing your 1099 forms in-house, order your forms early from www.formsforintacct.com so that you have them in time for printing to prevent unnecessary stress. Order plenty of forms to allow for errors – we all make mistakes and so do printers!

When printing, generate a copy on plain paper and compare to your forms to check alignment. If adjustments are needed, visit the Sage Intacct article titled “1099 print alignment” for guidance on updating the form alignment.

1099 E-Filing via Marketplace Partners

Sage Intacct will allow you to export the 1099 records to Excel, but does not provide any vendor form delivery or e-filing service for your 1099 Forms. Review the Sage Intacct Marketplace for options on e-filing, if interested.

Tax1099.com is a Sage Intacct Marketplace Partner that can provide IRS-approved e-file options for 1099, 1098, W2, and 940/941/944 filing. This tool has integrations with Sage Intacct and Bill.com software programs, which allows you to avoid duplicative data entry for 1099 processing.

Payroll Preparations

Since Sage Intacct does not have a payroll solution, you probably have this area covered via a third party provider. However, below are a few important dates related to payroll for your year-end calendar.

|

Deadline |

Item |

|

2/1/2021 |

W-2 Form – Employee Copy* |

|

2/1/2021 |

W-2 & W-3 Forms – Federal Filing |

|

2/1/2021 |

940 & 941 Forms – Federal Filing |

|

3/1/2021 |

1094 & 1095 Forms – Federal Paper Filing |

|

3/2/2021 |

1094 & 1095 Forms – Employee Copy* |

|

3/31/2021 |

1094 & 1095 Forms – Federal Electronic Filing |

* The IRS recommends providing these documents to employees as early as possible to reduce the number of filed corrections required.

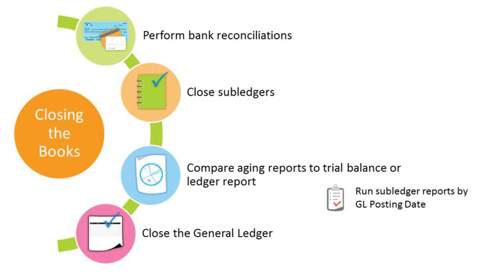

Closing the Books

Closing your months and year within your accounting system is an important step in controlling your company’s books. This process is important, as it controls posting to prior months, so it limits dating errors. General Ledger closing for the year in Sage Intacct is essentially the same process as closing any other period. This task requires proper permissions within Sage Intacct and can be performed from the top-level or entity-level.

Prerequisite

For fiscal years that operate in a different range than a standard calendar year, you must first create the reporting period.

- To view or create a new reporting period, go to General Ledger > Setup > More > Reporting Periods.

- For example, if your fiscal year runs from March through February, create a reporting period named "Fiscal Year ending 2019" to include the full period.

For fiscal years that match calendar years, the reporting period is automatically created for you during the closing process.

Close the Books Process

Within Sage Intacct, you can close transactions in sub-ledgers for the appropriate "year ending" period. Periods that have not yet been closed should appear within the drop-down list in the Close window. To close sub-ledgers and the General Ledger together, go to General Ledger > All > Books > Close. As needed, close sub-ledgers (or summaries) for Accounts Payable (AP), Accounts Receivable (AR), Time & Expenses (TE), Client Expenses (CE), and Cash Management.

We hope this article helps ease the anxiety of the approaching year-end and allows you to begin creating a plan of action to accomplish your year-end tasks with ease! If you have questions about Sage Intacct or its functions, contact our team and we will be happy to help.