Effective May 21, 2023, P&N has joined EisnerAmper. Read the full announcement here.

As the economic impact from COVID-19 continues to create uncertainty in traditional business models, many companies are seeking alternative strategies for navigating the current market environment. In this article, we will discuss the impacts of this pandemic on both the national and local economies.

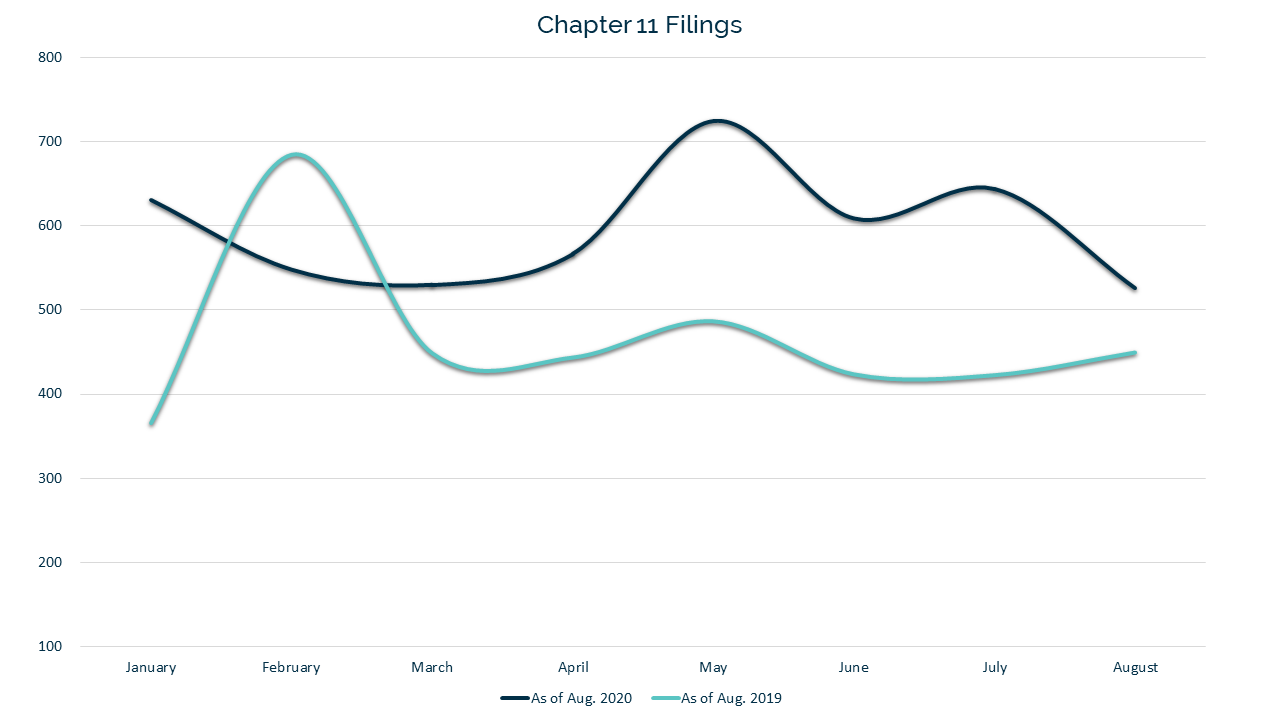

Bankruptcy trends over time

In the first eight months of 2020, there have been 4,780 Chapter 11 bankruptcy filings.[1] At the same point in 2019, there were only 3,728 filings, representing a 28% increase year over year. Similarly, the three-year average from 2019 to 2017 for Chapter 11 filings was about 3,700.

While the pandemic’s negative impact continues to evolve, the number of monthly bankruptcy filings demonstrates that the volume of filings is beginning to slow. Chapter 11 filings peaked between May and July, whereas August had the fewest number of filings in 2020. One reason for the decrease is the government sponsored programs, which are keeping businesses afloat. On April 3rd, 2020, the Small Business Administration (SBA) opened the first round of forgivable loans as part of the comprehensive Payroll Protection Program (PPP) enacted by the U.S. Congress. An analysis of U.S. Department of Labor hiring reports showed that through June, over seven million jobs had been recovered from the more than twenty million jobs lost in March and April.[2]

Impacts on different industries

The slowing rate of filings coupled with an increase in hiring implies that companies filing between May and July were most likely experiencing financial distress prior to the pandemic. For example, industries such as oil & gas and retail were already experiencing disruption due to sustained low energy prices and changing consumer spending trends, respectively.

The pandemic impacted industries that were experiencing all-time high performance.

The energy sector has experienced several price shocks over the past decade, including in July 2014 when the price of WTI crude dropped sharply from a high of more than $100/barrel. WTI has averaged just $50/barrel[3] since 2015. In the case of large brick and mortar retailers (e.g., Pier 1, J. Crew, and J.C. Penney), online shopping trends became increasingly popular, which disrupted that industry over the last few years.

However, the pandemic also impacted industries that were experiencing all-time high performance, including food service, travel, hospitality, and tourism. Through March 2020, the U.S. unemployment rate was at an all-time low[4] and disposable personal income was at an all-time high.[5] Government-mandated stay-at-home orders, shut downs, and occupancy limits on businesses have artificially depressed the economy and consumer discretionary spending. The aforementioned industries have relied heavily on loans from SBA programs to mitigate these issues and, in some cases, stay solvent.

Is recovery within reach?

Over the past two months, state and local economies have begun to relax COVID-19 related restrictions. The state of Louisiana moved to Phase 3 in early September, however, some local municipalities, such as Orleans Parish, opted to keep stricter parameters in place for varying lengths of time. This raises the question: If the economy is not opening fast enough, how long will the lingering effects of the pandemic negatively affect consumer spending?

On Friday, October 2nd, 2020, the U.S. Labor Department released its report on monthly hiring, which noted a decrease in the rate of hiring for the third straight month after peaking in June. Only 661,000 jobs were added to the economy in September, a steep decrease after 1.5 million were added in August and 1.8 million in July. Major headlines included The Walt Disney Company announcing 28,000 layoffs, as well as United and American Airlines furloughing a total of 32,000 employees.

As PPP funds are now almost extinguished, and shut down orders are being relaxed conservatively, a second wave of Chapter 11 filings may be on the horizon.

[1] Per Epiq Systems.

[2] U.S. Department of Labor, Bureau of Labor Statistics.

[3] Federal Reserve Bank of St. Louis. In April 2020, the quoted price of WTI crude briefly turned negative.

[4] U.S. Department of Labor, Bureau of Labor Statistics.

[5] U.S. Department of Commerce, Bureau of Economic Analysis.