Effective May 21, 2023, P&N has joined EisnerAmper. Read the full announcement here.

.jpg)

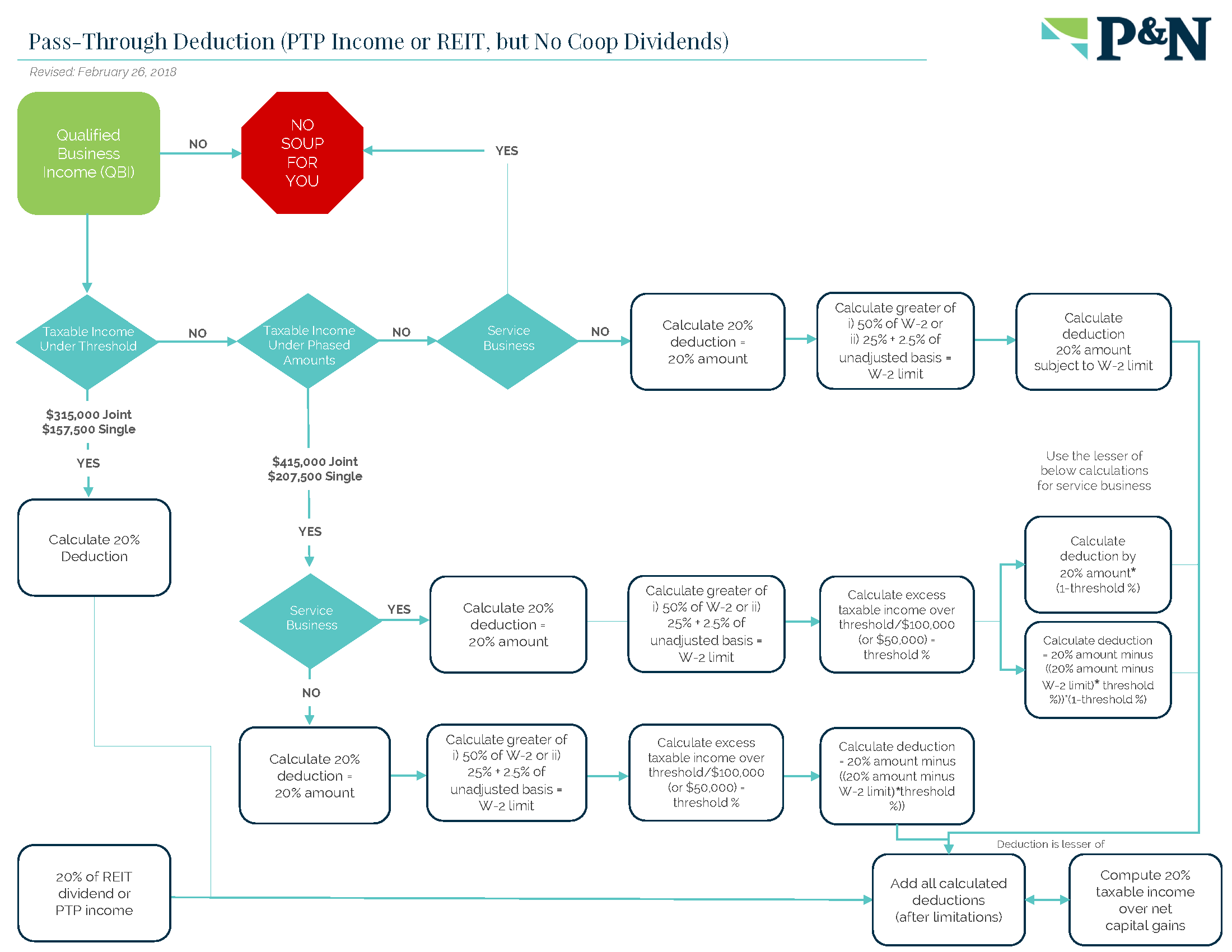

In December of 2017, Congress passed, and President Trump signed, the Tax Cut and Jobs Act which made sweeping changes to the U.S. tax code. One of the more revolutionary changes was the creation of a deduction for owners of pass-through entities. This deduction is equal to 20% of the qualified business income passed through to each partner/member of a pass-through entity. Below, a flow-chart outlines the application of the deduction. However, there are a few key points to remember about the deduction.

- The deduction applies to every non-corporate taxpayer who receives income from a pass-through entity as long as their total taxable income is lower than the threshold amount ($157,500 for single filers/$315,000 for joint filers).

- Once the threshold is reached, the deduction is limited in one of the following ways:

- Specified Service Businesses: Once the taxable income threshold is reached, the deduction is phased out for income from certain specified service businesses (g., health, law, consulting, brokerage services, accounting, actuarial services, financial services, athletics, performing arts, investment services, or any trade or business where the principal asset of the business is the reputation or skill of one or more of its owners or employers).

- Non-Service Businesses: Once non-service businesses reach the taxable income threshold, the 20% deduction begins to be limited by the amount of wages paid within the business or a combination of the amount of wages paid plus a percentage of the cost-basis of the assets used within the business.

Pass-Through Deduction Flowchart

The above chart and explanation outlines the general application of this deduction. More guidance is expected to be issued about the I.R.S.’s exact interpretation of the deduction and its application in special situations. As you review this new change to determine its application to your business, please contact your P&N professional for any questions about the how deduction applies to your situation.

Tax Reform Help

If you want to learn more about tax reform or have questions, please visit our tax reform page or contact us.