Effective May 21, 2023, P&N has joined EisnerAmper. Read the full announcement here.

All recipients of Provider Relief Fund (PRF) payments must comply with the reporting requirements described in the Terms and Conditions and specified in directions issued by the U.S. Department of Health and Human Services (HHS) Secretary. There is an upcoming reporting deadline on September 30, 2021 for certain PRF recipients.

The PRF provides payments to healthcare providers who diagnose, test, or care for individuals with possible or actual cases of COVID-19, and have healthcare-related expenses or lost revenues attributable to COVID-19.

Related Article: HHS Portals & Resources

Is Your Organization Required to File a Report?

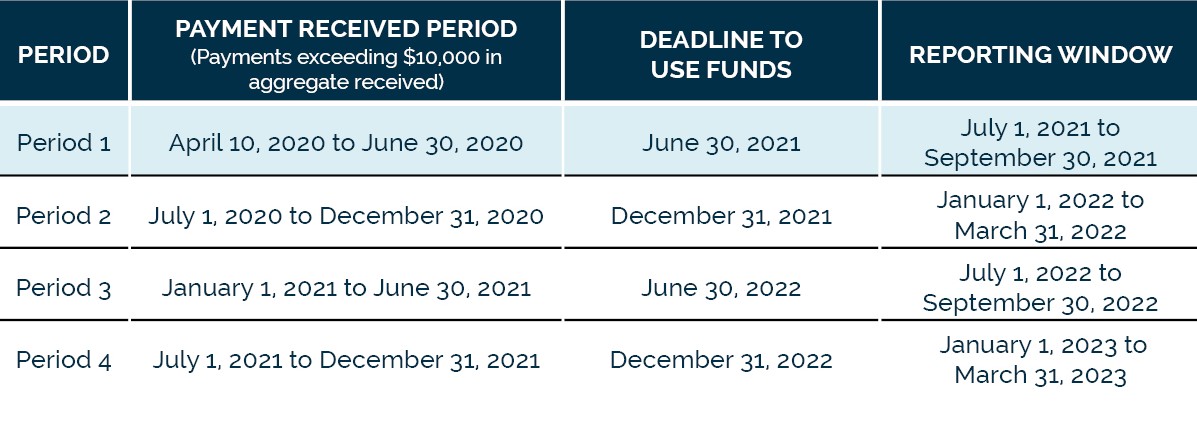

If an organization received one or more payments exceeding, in the aggregate, $10,000 during Payment Received Period 1 (April 10, 2020 to June 30, 2020), a report is due in the PRF Reporting Portal by September 30, 2021.

In response to challenges providers are facing given the COVID-19 surges and natural disasters around the country, HHS has announced a 60-day grace period. However, the reporting deadline for Payment Received Period 1 of September 30, 2021 has not changed. While the deadlines to use funds and the reporting time period will not change, HHS will not initiate collection activities or similar enforcement actions for noncompliant providers during this grace period. A few important items clarified in the September 10, 2021 announcement from HHS include:

- While you will be out of compliance if you do not submit your report by September 30, 2021, recoupment or other enforcement actions will not be initiated during the 60-day grace period.

- The grace period begins on October 1, 2021 and will end on November 30, 2021.

- Providers who are able are strongly encouraged to complete their report in the PRF Reporting Portal by September 30, 2021.

- Providers should return unused funds as soon as possible after submitting their report. All unused funds must be returned no later than 30 days after the end of the grace period (December 30, 2021).

- This grace period only pertains to the Reporting Period 1 report submission deadline. There is no change to the Period of Availability for use of PRF payments.

Filing the Report

If required to file a report, an organization will submit the required information into the PRF Reporting Portal. Gather necessary information for your organization using the Health Resources and Services Administration (HRSA)-provided worksheet. The worksheet is designed to help prepare providers for data entry, and can be downloaded here.

An entity will report on the following information:

- Dates and amounts of all other program money received (Paycheck Protection Program, Economic Injury Disaster Loan, or other awards received)

- Confirmation that PRF funds were used for COVID-19-related expenses; or lost revenue calculation by quarter

- Entities that received $499,999 or less in PRF funds will report COVID-19-related expenses in two categories: healthcare-related, and general and administrative.

- Entities that received $500,000 or more in PRF funds will report COVID-19-related expenses in greater detail

Important deadlines for this period and future periods include:

Provider Relief Fund Reporting Requirements and Auditing

Recipients that spend a total of $750,000 or more in federal funds, including PRF payments and other federal financial assistance, during their fiscal year are subject to single audit requirements, as set forth in the regulations at 45 CFR 75 Subpart F.

Need help?

While you focus on continuing to provide patient care, P&N’s experienced team of health care business advisors can help your organization navigate funding opportunities and maintain compliance. Contact us today to discuss how we can help.

.jpg)